May 29, 2024 at 3:00 AM PDT

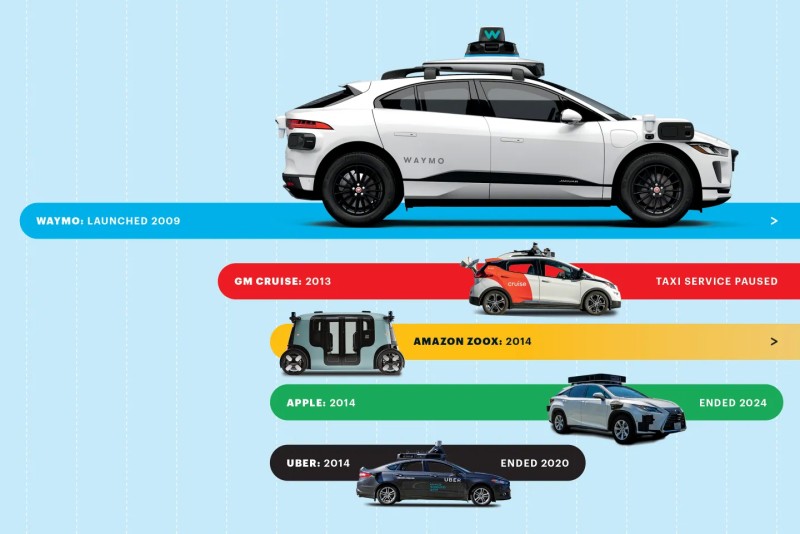

ENDURANCE RACE: A wide range of companies have entered, and quit, the self-driving car contest over the years.

From Top: Courtesy of Waymo; Courtesy of Cruise; Courtesy of Zooz; Andre J. Sokolow—Picture Alliance/Getty Images; Gene J. Puskar—AP Photo

The road to autonomous driving is not for the faint of heart.

Look behind to view the wreck of Uber’s self-driving car. In the ditch to the left is General Motors’ Cruise robo-taxi. And that scent of burning rubber? That’s from the skid marks Apple made as it careened toward the exit ramp.

But one funny-looking vehicle appears to be gaining momentum.

Waymo, born 15 years ago as the “Google Self-Driving Car Project,” now offers fully autonomous rideshare services in Phoenix—where its driverless vehicles also make Uber Eats deliveries—as well as in San Francisco and part of Los Angeles; 50,000 paid Waymo rides take place across the three cities each week, the company recently announced.

That paying passengers now routinely hop into empty Waymo vehicles, which gracefully move among the surrounding jumble of human-piloted cars, is a remarkable feat of engineering and a genuine pinch-me moment for anyone who has experienced it. And while Waymo has been at it longer than most, the fact that it has become the leader in the crowded race to commercialize self-driving cars was not a given.

Frederic Bruneteau, the founder of Ptolemus, a Brussels-based automation consultancy and market research firm, likens the competition in the self-driving car industry to the grueling Tour de France bicycle race: “Sometimes you see people catching up with you, and sometimes you’re getting ahead and the number of people behind you are pretty scarce. That’s what’s happened with Waymo.”

50,000Total weekly Waymo rides in L.A., Phoenix, and San Francisco. Source: Waymo

Aman Nalavade, Waymo’s group product manager for growth and expansion, says a go-slow approach has proved to be the right strategy for this race. “We scale responsibly, as it’s bad business to overrun supply,” Nalavade says. For technology as novel as fully autonomous vehicles, “it takes time to build up a meaningful service and gain a community’s trust.”

But even the most bullish believers in autonomous transportation acknowledge the tech still has a ways to go before it’s reliable enough for widespread deployment on U.S. roads. And while Waymo has outlasted its rivals so far, new challenges on the regulatory and competitive front mean that it’s closer to the next phase of the race than it is to the finish line.

From moonshot to reality

Google launched its self-driving car program in 2009, incubating it within the X “moonshot” lab before spinning it out as a stand-alone business called Waymo (“a new way forward in mobility”) within the Alphabet parent company. The car’s physical design and functionality, as well as the team’s leadership, have gone through multiple transformations since then.

Google initially designed the technology as a copilot system that allowed human drivers to let go of the controls, retaking the wheel only when necessary, but concluded the approach was unsafe. In 2015, the company began building its own pod-shaped “koala” car—a two-seater with no pedals or steering wheel—only to revert in 2017 to using modified versions of commercially available cars. Today Waymo’s fleet consists of Jaguar I-Pace electric SUVs equipped with an array of sensors.

There’s been no shortage of problems and setbacks. In December, Waymo recalled its vehicle software after two of the cars crashed into a pickup that was being towed in Phoenix. And U.S. regulators recently opened an investigation into 22 reported incidents involving Waymo cars, including 17 collisions with stationary objects such as gates and parked cars, and multiple occasions where the vehicles appeared to disobey street signs and road markings.

But whether the result of superior safeguards or mere luck, Waymo has managed to avoid the more serious road accidents that have derailed its rivals. Uber abandoned its self-driving car efforts in 2020, two years after one of its cars fatally struck a pedestrian in Arizona. A Cruise vehicle in October hit and dragged a pedestrian who had been thrown into its path after being struck by another car. Regulators made Cruise suspend its driverless operations in San Francisco, and Cruise soon halted operations nationwide.

250Waymo vehicles operating in San Francisco. Source: Waymo

It was a major setback for Cruise, which, just months earlier, had gotten California regulators’ green light to offer driver-free robo-taxi services to paying customers any time of day in San Francisco. Cruise has not provided a date for when it plans to resume its robo-taxi passenger service, but recently began testing cars with human safety drivers in Arizona again.

Apple, meanwhile, called it quits in February, shutting down an expensive yearslong project that never reached the point of testing without human safety drivers on public roads.

Waymo’s ability to “mostly stay clear of trouble,” along with its steady geographical expansion and its investors’ deep pockets, has put the robo-taxi operation “into a very good position,” says Pedro Pacheco, a vice president of research at Gartner. While other autonomous driving companies might be tempted to move too fast in order to justify themselves to their investors, he adds, Waymo’s situation as a mostly autonomous sister company to the cash-generating Google gives it “the comfort to take a somewhat cautious pace of growth.”

What comes next

The heat may soon be on again, as Tesla CEO Elon Musk has promised that his company will reveal its own robo-taxi in early August.

Tesla has so far not been a direct competitor to Waymo—its fallaciously named “full self-driving” (FSD) technology is more akin to an advanced driver-assist system, requiring a human driver to be attentive at all times (known as Level 2 autonomy in industry jargon, versus Waymo’s Level 4 vehicles, and Level 5, the highest).

While the two companies’ vehicles use different hardware to navigate the roads—Teslas rely solely on cameras; Waymo cars draw data from cameras plus radar and lidar laser sensors—AI will play an increasingly important role.

Tesla’s fleet of hundreds of thousands of vehicles constantly feed data to the company’s neural networks so that its FSD software can learn to drive more like humans do. This year’s version of the software, FSD 12, is the first to let the neural network make decisions about driving. According to Gartner’s Pacheco, Tesla’s self-learning approach is a “hint of the direction in which this is heading, and now an AI breakthrough could unlock a lot of new possibilities for autonomous vehicles.”

Waymo’s Nalavade says AI “has long been a part of our stack, but its role has grown massively in recent years.” The progress in AI, he notes, has made Waymo’s recent expansion possible by allowing its systems to “generalize”—to apply previously learned lessons to new environments, rather than having to start from scratch in each new place. “The Waymo Driver [system] is capable of generalizing to dozens more cities tomorrow, but we’re focused on building a valuable ride-hailing service that people want to use in the cities [in which] we operate,” he says.

While an imminent Tesla robo-taxi has many doubters given Musk’s history of overly optimistic timelines, there are plenty of other players with no intention of ceding the future of automobiles to Waymo. Amazon subsidiary Zoox has a robo-taxi currently shuttling employees to work in certain locations. Automakers like Ford, Volkswagen, and Mercedes-Benz are driving hard (often in partnership with startups) toward Level 3 systems, which still require occasional human intervention. And China’s rising band of automakers have various projects in the works.

“We’re far from getting to the final chapter of robo-taxis,” says Pacheco.

This article appears in the Jun/July 2024 issue of Fortune with the headline “How Waymo steered to the front of the pack and made self-driving taxis a reality.”